UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.DC 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section

PROXY STATEMENT PURSUANT TO SECTION 14(a) of the

OF THE SECURITIES EXCHANGE ACT OF 1934

Securities Exchange Act of 1934 (Amendment(Amendment No. )

Filed by the Registrant ☒

| Filed by the Registrant |  | Filed by a Party other than the Registrant |

| Check the appropriate box: | |

| Preliminary Proxy Statement |

| Confidential, for Use of the Commission Only (as permitted by Rule 14A-6(E)(2)) |

| Definitive Proxy Statement |

| Definitive Additional Materials |

| Soliciting Material under §240.14a-12 |

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to §240.14a-12

IQVIA HOLDINGS INC.

(Name of Registrant as Specified Inin Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| Payment of Filing Fee (Check all boxes that apply): | |

| |

|

|

| Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

|

Accelerating innovation for a healthier world

OUR MISSION

IQVIA’s mission is to accelerate innovation for a healthier world. This focuses us on enabling life sciences clients and broader healthcare stakeholders to accelerate the clinical development and commercialization of innovative medical treatments.

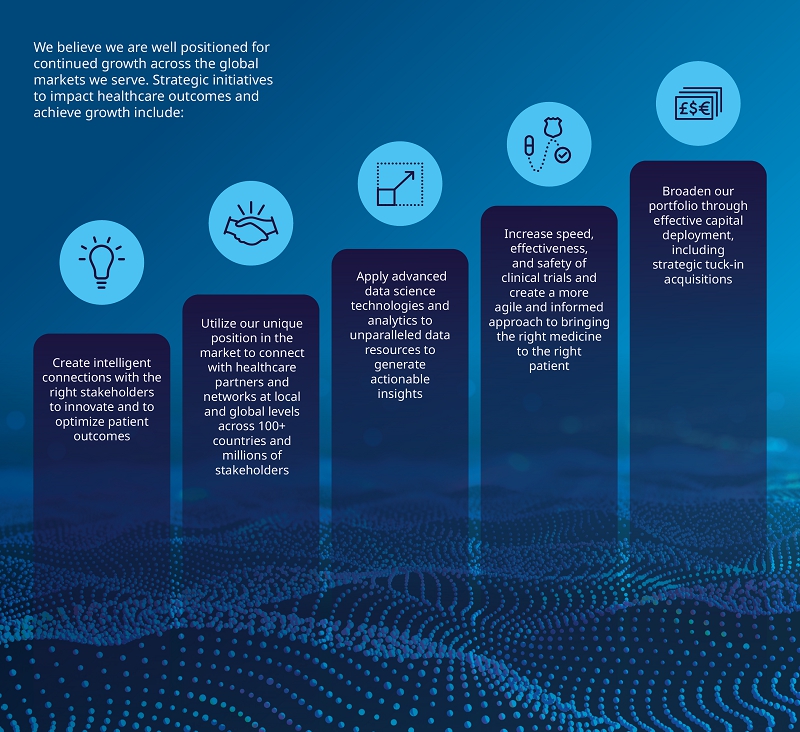

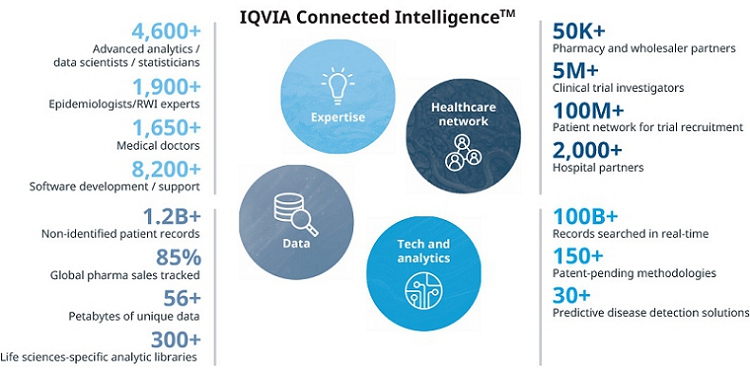

OUR STRATEGY

Our strategy is to utilize IQVIA Connected Intelligence™, the integration of unparalleled data, AI-powered analytics, transformative technology, extensive domain expertise, and an unmatched network of partners, to advance healthcare and improve patient outcomes by delivering actionable insights and powerful solutions to our clients and stakeholders.

|

NOTICE

OF 2024 ANNUAL MEETING OF STOCKHOLDERS

|

☐ Fee paid previously with preliminary materials.

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

| |

|

|

|

|

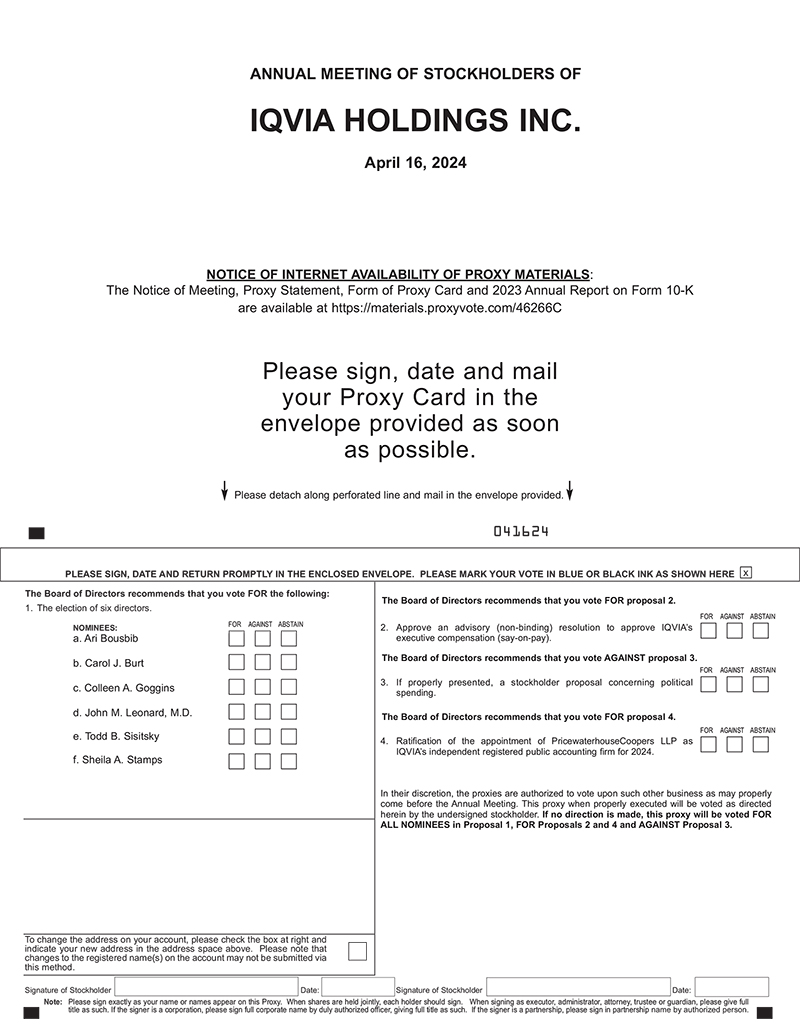

Dear Stockholder:

You are cordially invited to attend the 20222024 Annual Meeting of Stockholders of IQVIA Holdings Inc. (2024 Annual Meeting) on Tuesday, April 12, 2022,16, 2024, at 9:00 ama.m. E.D.T. at the Hilton Garden Inn Danbury, 119 Mill PlainHotel Zero Degrees, 15 Milestone Road, Danbury, Connecticut. TheThis Notice of 2022 Annual Meeting, of Stockholders and the Proxy Statement accompanying this letter, describedescribes the business to be conducted at the meeting2024 Annual Meeting and provideprovides further information about IQVIA.

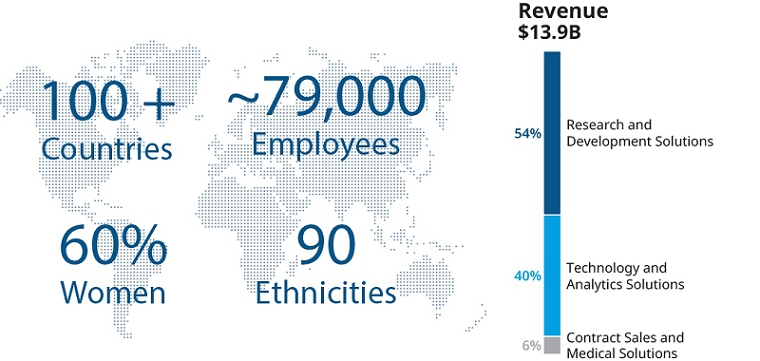

At IQVIA, we remain keenly focused on our purpose of accelerating the advancement of innovative medical treatments that improve patient lives. This past year marked five years since the formation of IQVIA, the result of the merger between IMS Health and Quintiles in 2016. During this time, we built a truly unique organization with over 79,000 employees, a global client base of over 10,000 life sciences companies, regulators, payers and providers, in 100 countries, and an unmatched set of technology & analytics capabilities.

Since forming IQVIA, our goals have been ambitious. For the first three years following the merger, we focused on integrating our capabilities and applying them to improve the clinical trial process. In 2019, we launched our Vision22 strategy to accelerate growth and profitability by the end of 2022, and we are on track to achieve these goals as we begin the final year of this strategic plan.

We are now at another inflection point in IQVIA’s journey. This past year our management team began to work on the strategy for the next phase of our growth. We call this new strategic plan 20by25, which alludes to our goal of accelerating innovation-led growth to double digits annually, resulting in IQVIA becoming at least a $20 billion revenue company by the year 2025. This is an ambitious target given our existing large global scale, but through our unique capabilities and expansive customer base, we believe these goals are achievable.

| AGENDA | ||

2022 Proxy Statement 2022 Proxy Statement | ||

| Proposal 2: | Approve an advisory (non-binding) resolution to approve our executive compensation (say-on-pay) | |

| Proposal 3: | Consider a stockholder proposal, if properly presented | |

| Proposal 4: | Ratify our Audit Committee’s appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 2024 | |

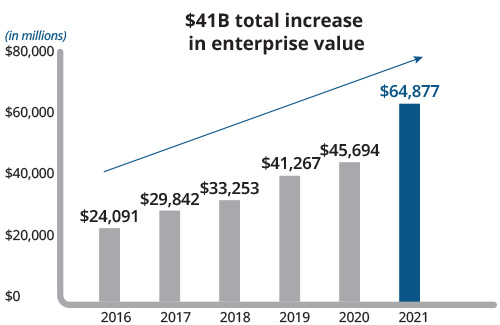

2021Financial&OperationalHighlights

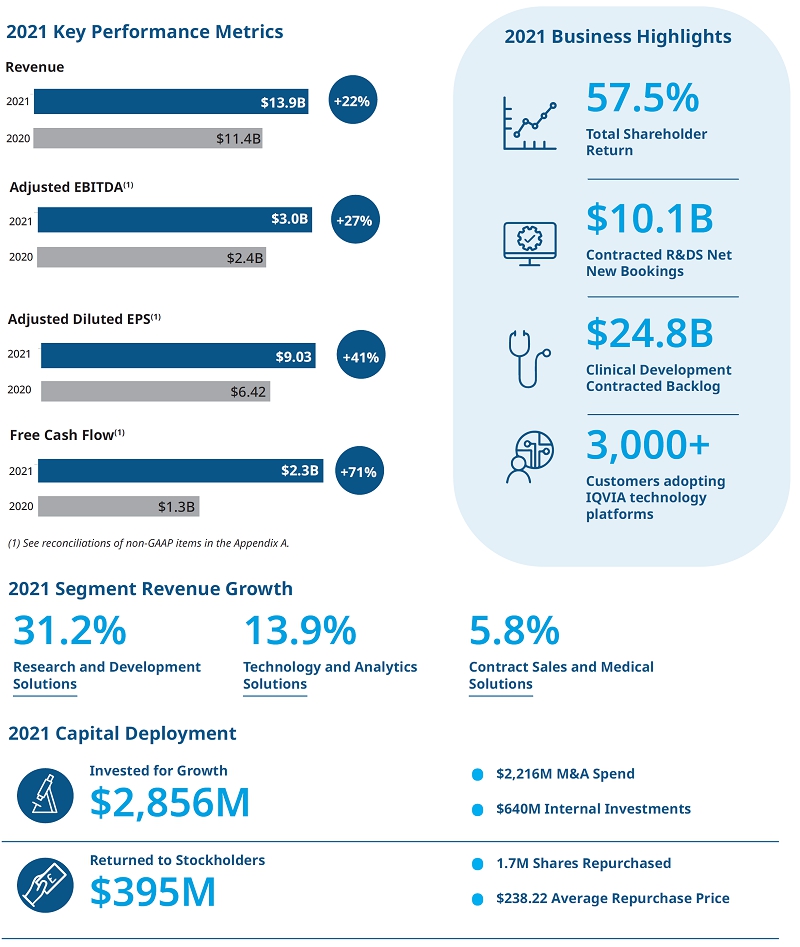

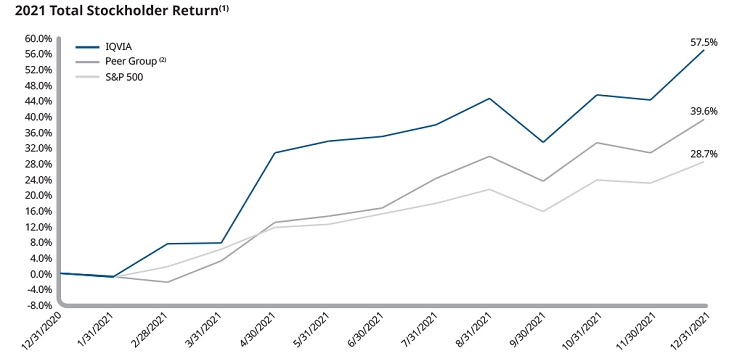

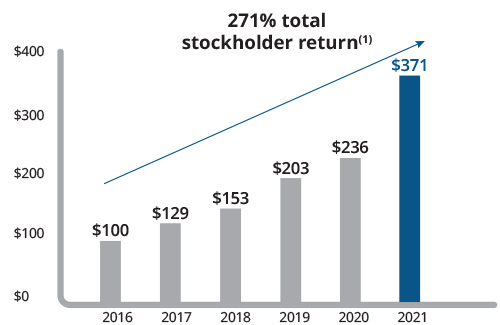

This year, COVID-19 continued to surge across many parts of the world, however, it did not have a material impact on our operations, as we have learned to work through these challenges. In fact, in 2021, we accelerated the pace of investment across theOther business, and significantly exceeded all key financial and strategic goals. Reported revenue grew to$13.9 billion, representing22.1% year-over-year growth. Our Research and Development Solutions (R&DS) and Technology and Analytics Solutions (T&AS) segments contributed significantly to our results, delivering31.2% and13.9% growth, respectively. Adjusted EBITDA grew26.8% to$3 billion and Adjusted Diluted Earnings per Share (EPS) of$9.03 increased40.7%. Our Free Cash Flow continued its substantial improvement trend and increased to$2.3 billion. Our investor base continued to expand and to respond accordingly: our share price performance provided a total stockholder return of 57.5%.

Our strong balance sheet, flexible capital structure and strong Free Cash Flow performance enabled key investments to further drive innovation, as well as to return cash to shareholders. We invested $640million in new product development and technology infrastructure. During 2021, we also completed a number of strategic acquisitions across our portfolio of businesses. In R&DS, we purchased the remaining non-controlling interest in our lab joint venture from Quest Diagnostics, and we acquired MyriadRulesBasedMedicine to bolster our bio-marker lab testing capabilities in key therapeutic areas. In T&AS, we strengthen our position in the digital omnichannel marketing space with the acquisition of DMDMarketingSolutions. We also returned $395million to shareholders through the repurchase of 1.7million shares.

These strong results were driven by numerous operational achievements across our organization, as we:

Delivered a record $10.1billion in contracted net new bookings and our clinical development contracted backlog at December 31, 2021 reached a record $24.8billion.

Expanded the uptake of our industry-leading Decentralized Clinical Trial (DCT) capabilities. We now have over 300 studies worldwide, enrolling more than 300,000 patients in 80 countries across more than 30 indications, using at least one of our DCT solutions.

Expanded the adoption of IQVIA technology platforms to over3,000customers, with over 350 clients adopting one or more applications on our OrchestratedCustomerEngagement(OCE) platform since launch.

Launched new products in-line with our product strategy. This included IQVIANextBestAction, an artificial intelligence (AI)-driven technology and analytics tool that provides alerts, triggers, and recommendations to sales teams to support customer engagement. In its first year, it has already been deployed by twotop-20pharmaceuticalclients across over 40brands and in 30countries.

Built on our leading position in Real World Evidence with the expansion of our rich clinical data assets to over1.2billion non-identified patients globally.

$13.9B

Revenueif properly raised.

$3.0B

Adjusted EBITDA

$9.03

Adjusted DilutedEarnings perShare

$2.3B

Free CashFlow

2022 Proxy Statement 2022 Proxy Statement |

2021ESGHighlights

We are proudThe Board of the many business accomplishments we had this past year, but it is especially meaningful to see how our approximately 79,000 employees have embraced our ambitious Environmental, Social,Directors recommends that you vote “FOR” each director nominee included in Proposal 1 and Governance (ESG) goals“FOR” Proposals 2 and supported an expansion4. The Board of Directors recommends that you vote “AGAINST” Proposal 3. The full text of these programs during 2021. As an organization, our commitment to these efforts is unwavering, and we will continue reporting progress with complete transparency. Below are selected examples of the significant progress we made towards advancing our ESG goals:

Increased ESG transparency through adoption of globally recognizedTaskforce for Climate-related Disclosures(TCFD), Global Reporting Initiative(GRI) and Sustainability Accounting Standards Board (SASB) reporting standards

Increaseddisclosuresonthegenderandracial/ethnicdiversity of our workforce through publication of our Employee Information Report (EEO-1) report

Increasedthegenderandracial/ethnicdiversityofourBoard with recent director appointments — currently 4 of our 11 directors are women

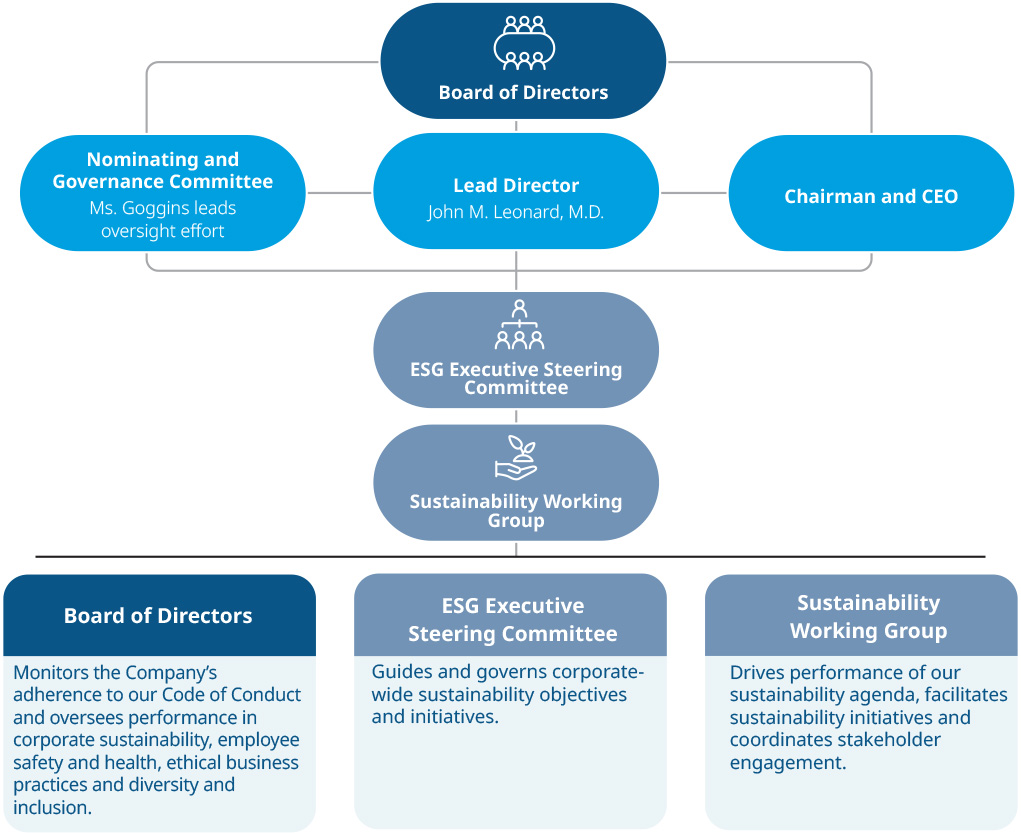

Increasedthegenderandracial/ethnicdiversityprofileofourworkforce:

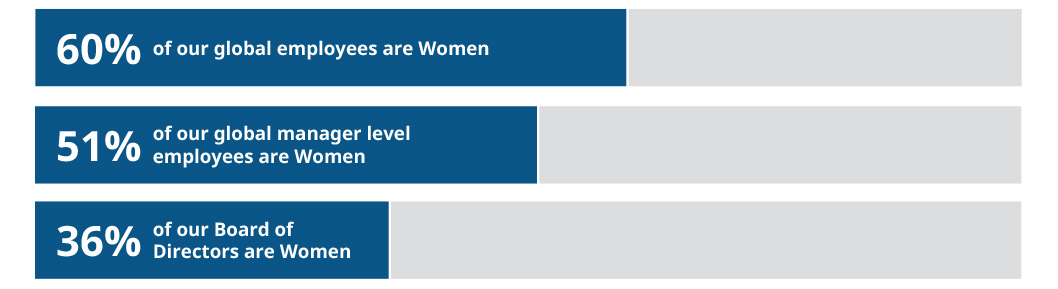

60% of our global workforce and 51% of our manager-level employees globally are women

46% of new hires in the U.S. identify as non-white, including 13% who identify as Black or African American, which is significant because as a group new hires were more diverse than our overall U.S. workforce in 2021, confirming that we are recruiting racially and ethnically diverse candidates at a rate that outpaces the diversity of our current U.S. workforce

ExpandedtheEmployeeResourceGroup(ERG)program with two new groups and increased total employee participation in these programs

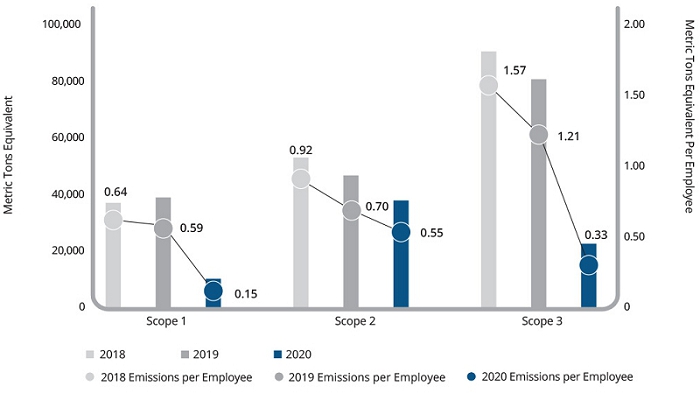

Reducedourtotalandper-employeeGreenhousegas(GHG)emissionsyear-over-year beyond our expectations

Transitionedto100%renewableenergysupply at our Scotland Laboratory and initiated efforts for other facilities to achieve the same over time

Committedtosettingascience-basedtarget by end of 2023 to reduce our carbon emissions

The events of the past few years highlighted the critical role we play in healthcare. Throughout 2021, we continued to make progress advancing global healthcare and improving outcomes for populations around the world. Our industry-leading DCT platform brings the clinical trial to the patient rather than the patient to the trial. This significantly reduces the burden for patients enrolled in clinical trials and allows IQVIA to increase patient recruitment among historicallyunderservedandmorediversepopulations.These solutions were critical to the development of COVID-19 vaccines and treatments. Additionally, COVID-19 trials required broader testing, including, critically, in diverse populations. Our innovations allowed COVID-19 vaccine trials supported by IQVIA to achieve diversity enrollment rates 1.7xbetterthan other comparable COVID-19 vaccine trials. We also expanded the reach of our patient registry technology to 80+clinicalprograms.These programs have enrolled morethan21millionpatients.These solutions capture critical information about diagnosis, treatment, and outcomes for a range of disease areas. This data is used by government and academic research organizations and patient advocacy groups to inform new research and treatment protocols that have a tangible impact on patient lives.

We were particularly inspired and honored to collaborate with a wide range of stakeholders to strengthen public health system foundations and address key barriers to access across more than 200+ healthcare facilities across Sub-SaharanAfricaand to support a variety of nonprofits and programs in Indiathat focus on health, women, and education.

With the support of our employees, customers, partners, and stockholders, we will continue to build on our leading position within life sciences and global healthcare. For the fifth consecutive year, IQVIA was named to FORTUNE’slistofWorld’sMostAdmiredCompanies.In addition, we earned a first-placeranking in FORTUNE’s Healthcare:PharmacyandOtherServicescategory of its World’s Most Admired Companies list. Our commercial technology solutions were recognized as a LeaderinBPOSolutionsforPharmaceuticalSalesandMarketing by International Data Corporation (IDC)’s 2021MarketScapeTM, and we received six HumanCapitalManagementExcellenceAwards from the Brandon Hall Group recognizing our global talent development programs.

Our differentiated capabilities uniquely position IQVIA to address some of healthcare’s most complex challenges. We will continue to invest and innovate to advance patient outcomes and deliver value to our shareholders.

AriBousbib

ChairmanandChiefExecutiveOfficer

2022 Proxy Statement 2022 Proxy Statement |

NOTICE

of 2022 AnnualMeeting ofStockholders

AGENDA

Elect the four Class III director nominees namedproposals appears in the accompanying Proxy Statement for a three-year term

Approve our Amended and Restated CertificateStatement. Registered stockholders of Incorporationthe Company at the close of business on the record date are eligible to declassifyvote at the Board of Directors over time and provide for the annual election of all directors

Approve an advisory (non-binding) resolution to approve executive compensation (say-on-pay)

Consider a stockholder proposal, if properly presented

Ratify our Audit Committee’s appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 2022

Other business, if properly raised

By Order of the Board of Directors,

Eric M. Sherbet

Executive Vice President,

General Counsel and Secretary

February 28 , 2022Danbury, Connecticut23, 2024

Durham, North Carolina

Time, Date & Location

9:00a.m.E.D.T.

Tuesday, April 12, 2022

Hilton Garden Inn Danbury

119 Mill Plain Road

Danbury, Connecticut 0681116, 2024

TheBoardofDirectorsrecommendsthatyouvote“FOR”eachdirectornomineeincludedinProposal1and“FOR”Proposals2,3and5.TheBoardrecommendsthatyouvote“AGAINST”Proposal4.ThefulltextoftheseproposalsappearsintheaccompanyingProxyStatement.RegisteredstockholdersoftheCompanyatthecloseofbusinessontherecorddateareeligibletovoteatthemeeting.

We recommend that you review the information on the process for, and deadlines applicable to, voting, attending the meeting and appointing a proxy under “About the 2022 Annual Meeting” on page 107 of the Proxy Statement.Hotel Zero Degrees

15 Milestone Road

Danbury, Connecticut 06810

YOUR VOTE IS IMPORTANT

To make sure your shares are represented, please cast your vote as soon as possible in one of the following ways:

|  |  | ||

INTERNET

| ||||

| TELEPHONE

| |||

|

| |||

ImportantNoticeRegardingtheAvailabilityofProxyMaterialsforthe2022 2024 AnnualMeetingofStockholderstoBeHeld on April12,2022: 16, 2024:

Our Notice of Meeting, Proxy Statement, Form of Proxy Card & 20212023 Annual Report on Form 10-K are available at: https://materials.proxyvote.com/46266C

We recommend that you review the information on the process for, and deadlines applicable to, voting, attending the 2024 Annual Meeting and appointing a proxy under “About the 2024 Annual Meeting” on page 125 of the Proxy Statement.

IQVIA HOLDINGS INC.  2024 Proxy Statement 2024 Proxy Statement | 1 |

|

Message from our | IQVIA HOLDINGS INC. Durham, North Carolina 27703 |

| John M. Leonard, M.D. Lead Independent Director |

Dear Stockholders:

On behalf of the Board of Directors, I would like to thank you for your continued support of IQVIA. As your Lead Independent Director, it is my distinct pleasure to outline the efforts of the Board to provide robust, independent oversight in furtherance of your interests. Throughout 2023, consistent with prior years, the Board worked closely with our Chief Executive Officer and management team to further IQVIA’s overall mission, enhance our corporate governance program, advance our sustainability initiatives, and to proactively engage with our stockholders.

We provide robust corporate governance and independent oversight of the Company’s long-term strategy.

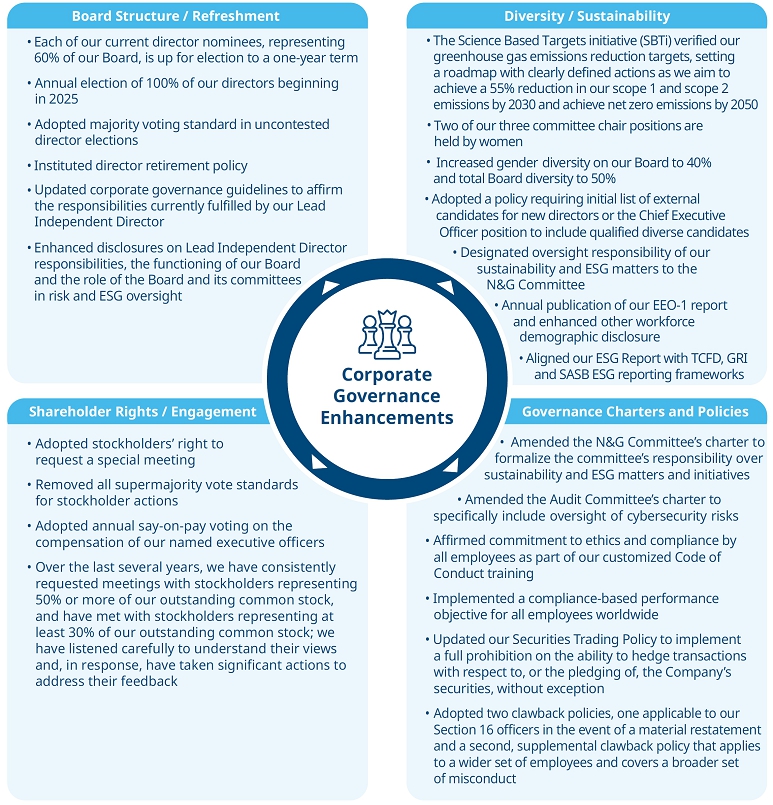

An essential role of the Board is to provide robust corporate governance and effective independent oversight of IQVIA’s corporate strategy and execution. The Board regularly reviews our corporate governance policies and practices and has continued to make enhancements that we believe are in the best interests of the Company and our stockholders. Key 2023 accomplishments include, among others:

| • | Adopted stockholders’ right to request a special meeting of stockholders |

| • | Continued declassification of the Board: 60% of our directors are up for election to one-year terms in 2024 and 100% of our directors will be up for election to one-year terms in 2025 |

| • | Adopted two clawback policies, one applicable to our Section 16 officers in the event of a material financial restatement and a second, supplemental clawback policy that applies to a wider set of employees and covers a broader set of misconduct |

| • | Increased transparency of our limited corporate political contributions through the publication of an annual Political Spend Report and public disclosure of our Political Activity Policy |

The Board works closely with our Chief Executive Officer and senior management to formulate and oversee the Company’s long-term strategy to ensure that we are well positioned to succeed in a complex and rapidly changing healthcare environment.

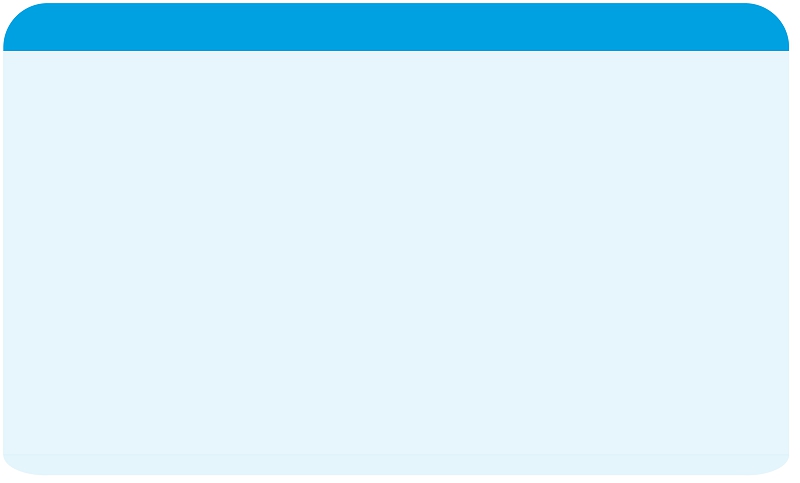

We oversee the Company’s sustainability initiatives.

The Nominating and Governance Committee (N&G Committee) of the Board has oversight responsibility of sustainability matters. Colleen Goggins, the Chair of the N&G Committee, and I actively advance our continuing sustainability efforts and initiatives through regular meetings with our Chief Executive Officer and management team and with our stockholders. We are very proud of our recent sustainability accomplishments, which include, among others:

IQVIA HOLDINGS INC.  2024 Proxy Statement 2024 Proxy Statement | 2 |

| • | The Science Based Targets initiative (SBTi) verified our greenhouse gas emissions reduction targets, setting a roadmap with clearly defined actions as we aim to achieve a 55% reduction in our scope 1 and scope 2 emissions by 2030 and achieve net zero emissions by 2050 |

| • | As disclosed in our 2023 Environmental, Social and Governance Report, our scope 3 emissions decreased by 31% in 2022 compared to 2021 |

| • | We disclosed specific targets on employee engagement survey results relative to benchmark scores for our named executive officers, which impact short-term compensation payouts, tying executive compensation to our human capital management efforts, which are critical to the Company achieving its financial results |

| • | Building upon past learnings and successes, launched new global Diversity, Inclusion & Belonging Plan, furthering our initiatives in this area through actions designed to support growth and innovation in our programs and processes |

We invite you to review our 2023 Environmental, Social and Governance Report, which is available on our website at https://www.iqvia.com/esg, and to learn more about our sustainability priorities and practices beginning on page 38 of this Proxy Statement.

We have a robust stockholder engagement program and engage regularly with our stockholders.

Engagement with stockholders remains a key focus for IQVIA and an important part of the Board’s longstanding commitment to sound governance practices and responsiveness to stockholder input. Our annual stockholder engagement program involves meetings with a broad base of stockholders to discuss performance, corporate governance, environmental and social impacts, human capital management, executive compensation and other matters of importance. During the past year, both Colleen and I regularly participated in these meetings. Our ongoing dialogue with stockholders provides us with valuable insight and feedback throughout the year, allowing the Board to better understand our stockholders’ priorities and perspectives and to incorporate them into the Board’s deliberations and decision-making processes. During 2023, we engaged with stockholders representing approximately 35% of our outstanding common stock.

As we move forward in 2024 and beyond, we will continue to work hard on your behalf as stewards of the Company to help ensure the continued success of IQVIA. On behalf of the full Board, I sincerely thank you for your continued trust and investment in IQVIA. Your vote is important, and we kindly request that you support our voting recommendations contained in this Proxy Statement and invite you to share your perspectives with us throughout the year.

Sincerely,

John M. Leonard, M.D.

Lead Independent Director

IQVIA HOLDINGS INC.  2024 Proxy Statement 2024 Proxy Statement | 3 |

|

Message from our | IQVIA HOLDINGS INC. |

| Ari Bousbib Chairman and Chief Executive Officer |

Dear Stockholders:

At IQVIA, our mission is to accelerate innovation for a healthier world. Our 87,000 global employees across more than 100 countries are passionate about solving healthcare’s most complex challenges. We integrate our cutting-edge technology with our world class services to deliver innovative solutions for over 10,000 life science, regulator and provider customers.

Our industry faced another year of unprecedented turmoil, with geopolitical instability and macroeconomic forces continuing to wreak havoc across the globe. Despite this tumultuous environment, I am proud that we delivered improvements across our key financial and operational metrics and, importantly, ensured patients maintained access to the critical therapies they need.

The outlook for our industry is extremely robust. The demand for innovation has never been greater, the funding for this innovation has never been higher, and the number of molecules in development has never been larger. More than 100 new oncology drugs are expected to be developed and commercialized in the next five years, as many as 50 cell, gene and mRNA therapies will come to market in that timeframe and the growth of the pharmaceutical market is expected to reach 8% CAGR by 2028. This is a time of unprecedented medical progress and IQVIA is uniquely positioned to support our industry deliver on its promise to improve patient lives.

Financial, Strategic and Operational Achievements

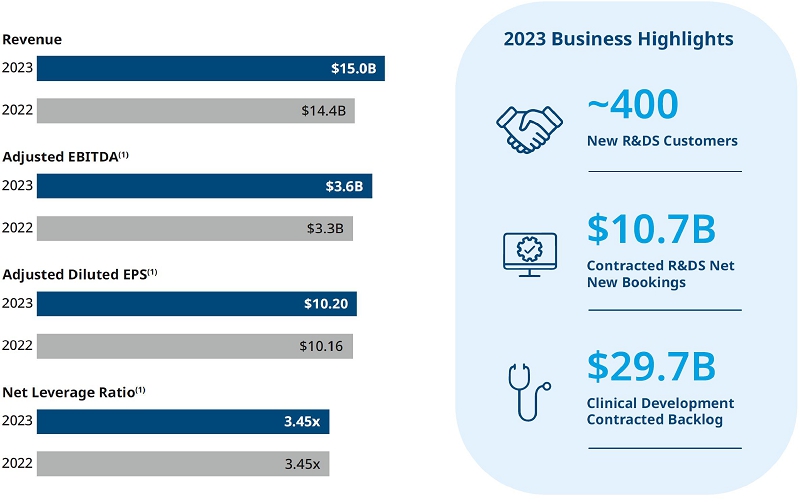

In 2023, revenue grew to $15.0 billion, representing 4% growth on a reported basis and 4.1% growth on a constant currency basis. Adjusted EBITDA, our primary measure of profitability, grew 6.7% to $3.6 billion and adjusted diluted earnings per share increased by 0.4% to $10.20. Adjusting for the impact of the step-up in interest rates and the UK corporate tax rate, adjusted diluted earnings per share grew by 12%.

Across each of our core business segments, we delivered on our expectations. Research & Development Solutions (R&DS) grew 6% on a reported basis, 6% on a constant currency basis and 13% at constant currency when we eliminate Covid-related business from both years. Our Contract Sales & Medical Solutions (CSMS) business declined by 2.2% on a reported basis and 0.3% at constant currency. Our Technology & Analytics Solutions (TAS) business grew 2.0% on a reported basis and 2.1% at constant currency.

This year we took the opportunity to refinance tranches of our debt with nearer term maturities. In November, we successfully refinanced approximately $2.75 billion dollars, effectively extending maturities to 2029 and 2031. The strong demand for IQVIA debt allowed us to tighten pricing and lock-in an average fixed rate below 4.9 percent after swaps. This refinancing reduced our interest rate risk with over 80 percent of our debt now at fixed rates.

IQVIA HOLDINGS INC.  2024 Proxy Statement 2024 Proxy Statement | 4 |

The strength of our balance sheet and strong cash flow allowed us to invest $649 million on internal development projects, deploy almost $1 billion to make strategic acquisitions and investments, and return approximately $1 billion of cash to stockholders through the repurchase of more than 5 million shares of our common stock at an average price of $197 per share.

Underpinning our financial performance were strong strategic and operational achievements, which included:

| • | A record year for the R&DS business: R&DS continued to |

| • |

|

| • | Industry leading analytics and AI: In 2023 we accelerated revenue growth in our emerging commercial analytics business by 50%. We launched IQVIA’s Healthcare-grade AI, our approach to AI that provides the level of speed, trust, and privacy that the industry needs. We received industry recognition for our use of AI across our pharmacovigilance and sales & marketing operations offerings. In June we were awarded the prestigious “Best AI-based Solution for Healthcare” Award from the Artificial Intelligence Breakthrough Awards. |

| • | Innovative patient offerings: We drove significant expansion of our commercial patient offerings through the launch of our AI-driven patient relationship management platform, the development of an obesity management program in collaboration with Apple, and expansion of our patient education, screening, and diagnostic services across Asia, Latin America, and Europe. |

Investments in Talent

IQVIA attracts talent that is passionate about improving patient outcomes. We invest heavily so our talent can accomplish this goal. This year we made significant progress against our learning and development agenda, for example we:

| • | Introduced our new onboarding app that personalizes new joiners’ experiences to facilitate a smoother onboarding experience, allowing new joiners to feel part of IQVIA sooner and be productive more quickly. |

| • | Launched our new Talent and Learning Hub, received over one million visits to our talent and learning hub and hosted more than 30,000 IQVIANs on Career Connections, our AI driven talent marketplace, exploring new careers and opportunities for growth within IQVIA. |

| • | Increased the numbers of IQVIANs who completed one of our structured leadership and management programs to build the next generation of management and leadership talent. |

We want our talent to be reflective of the communities we serve as well as feel that they belong at IQVIA so they can make a meaningful contribution to the Company’s mission. This year we have seen a 110% increase in our Employee Resource Group membership with almost 12,000 members across eight global ERGs representing 73 countries. We have 90 different ethnicities represented across our employee population, 61% of our global workforce are women, 52% of our global managers are women and 40% of IQVIA’s Board of Directors are women. In the U.S. alone, almost 40% of our employees identify as minority and 44% of new hires identify as minority.

Through our semi-annual Employee Pulse Survey, we continue to measure the progress we are making in employee engagement and satisfaction. 87% of employees see a clear link between their work and our shared vision, 5 points above the Fortune 500 benchmark. 79% of employees feel like they belong at the Company, 3 points above the Fortune 500 benchmark, and 88% feel they are acquiring the skills they need to be successful, 7 points above the Fortune 500 benchmark.

Environmental, Social and Governance Enhancements

In line with our commitment to net zero we verified our greenhouse gas emissions reduction targets - including our net zero by 2050 target - with the Science Based Targets initiative (SBTi). We reduced our absolute scope 3 emissions by 31% and removed over 3,000 kg of single use plastics from our business. In addition, we increased the reuse of electronic devices by more than five times. We continue to reduce our global real estate footprint and therefore our energy

IQVIA HOLDINGS INC.  2024 Proxy Statement 2024 Proxy Statement | 5 |

consumption and emissions. We now have thirteen labs across Europe, Asia and the Americas that have achieved the My Green Lab certification. In furtherance of our sustainability agenda, we continue to work with our suppliers to commit to and set SBTi targets, including mandatory training as part of their supplier agreements.

In support of our commitment to public health we established our dedicated global public health business in 2023. IQVIA Public Health now works with more than 75 clients across the globe. We partner with some of the largest NGOs in the world, including the Global Fund and (RED) to improve the detection of threats before they become pandemics in low to middle income countries. IQVIA also works with the Coalition for Epidemic Preparedness (CEPI) in support of its 100 Days Mission, an ambitious plan to compress vaccine development timelines to 100 days. In October we held our second annual Africa Health Summit in Kigali, Rwanda, bringing together nearly 300 healthcare stakeholders from 28 different countries to discuss how to address the diverse unmet needs across the continent.

IQVIANs continue to make a positive impact in their communities. In 2023, IQVIANs donated their time to a variety of community service activities. These included supporting adults with learning difficulties, helping students from disadvantaged backgrounds improve their career prospects, campaigning for stem cell donor registrations, staffing food banks, refurbishing schools and more. This generosity of spirit is truly humbling.

We are continually strengthening our corporate governance program, which is critical in supporting our sustainability goals, promoting accountability, and driving long term shareholder value. Since 2020, we have made more than 25 distinct enhancements to our corporate governance program, as well as added significant additional disclosures to provide greater transparency on our policies and practices. Our key accomplishments in 2023 were outlined by our lead independent director in his message above.

We were pleased to be recognized in FORTUNE’s annual list of World’s Most Admired Companies for the seventh year in a row. For the third year in a row, IQVIA was named the number one most admired company in our category, Healthcare: Pharmacy and Other Services. In addition, IQVIA earned first place ranking in six of nine categories, including quality of management, people management, innovation, quality of products and services, global competitiveness, and use of corporate assets.

Looking to 2024 and beyond, I am confident that our industry will weather the geopolitical and macroeconomic challenges we face. Demand for innovation remains strong as patients continue to look to our industry to provide the best possible outcomes for them and their families. As always, IQVIA stands resourced and ready to support our customers deliver for the patients we collectively serve.

I, and everyone at IQVIA, deeply value the trust that our customers, stockholders, and partners around the world continue to place in us. I look forward to keeping you updated throughout 2024.

Ari Bousbib

Chairman and Chief Executive Officer

IQVIA HOLDINGS INC.  2024 Proxy Statement 2024 Proxy Statement | 6 |

Table of Contents

| Proxy Statement Summary | 8 |

| Commitment to Public Health | 11 |

| Sustainability Highlights | 12 |

| Corporate Governance Highlights |

| 112 | |

| PROPOSAL NO. 3 Stockholder Proposal: |

IQVIA HOLDINGS INC.  2024 Proxy Statement 2024 Proxy Statement | 7 |

2022 Proxy Statement 2022 Proxy Statement |

Proxy Statement Summary

This

Proxy Statement Summary

This summary highlights information contained elsewhere in this Proxy Statement which is first being sent or made available to stockholders on or about February 28 , 2022. This summaryand does not contain all of the information you should consider, so pleaseconsider. You should read the entire Proxy Statement carefully before voting.

Matters to Be Voted Upon

The following table summarizes the proposals to be voted upon at the 20222024 Annual Meeting of Stockholders of IQVIA Holdings Inc. (IQVIA or the Company) to be held on Tuesday, April 12, 2022 (the “2022 Annual Meeting”)16, 2024, and the voting recommendations of the Company’s Board of Directors (the “Board”)Board) with respect to each proposal.

Proposals | Required

| Board

| Page

|

Election of |

| FOR each nominee |

|

|

|

|

|

Advisory (non-binding) vote to approve our executive compensation (say-on-pay) | Not applicable(1) | FOR |

|

Stockholder proposal, if properly presented | Not applicable(1) | AGAINST |

|

Ratification of PricewaterhouseCoopers LLP as our independent | Majority of votes cast | FOR |

|

(1)

| Given this is an advisory vote, there is no required approval threshold. |

| YOUR VOTE IS IMPORTANT |

| Please register for e-delivery of proxy |

IQVIA HOLDINGS INC.  |

Who We Are

We haveIQVIA has one of the largest and most comprehensive collections of healthcare information in the world, including more than 1.2 billion comprehensive, longitudinal, non-identified unique patient records spanning sales, prescriptions, promotions,prescription and promotional data, medical claims, electronic medical records, genomics and social media secured bymedia. We continue to grow our information set to offer even greater intelligence—we currently hold more than 61 petabytes of proprietary data sourced from approximately 150,000 data suppliers and over 1 million data feeds globally. As a wide varietyglobal leader in protecting individual patient privacy, we employ a range of privacy-enhancing technologies and safeguards.safeguards to protect individual identities all while generating insights at scale. With our sophisticated analytics and global technology infrastructure, we help our clients use this data to run their organizations more efficiently and make better decisions.

IQVIA HOLDINGS INC.  2024 Proxy Statement 2024 Proxy Statement | 9 |

Financial Highlights

2023 Key Performance Metrics

(1) See reconciliations of non-GAAP items in Appendix A of this Proxy Statement.

2023 Segment Underlying Revenue Growth(2) | ||||

| 13% | 6% | (1%) | ||

| Research and Development Solutions | Technology and Analytics Solutions | Contract Sales and Medical Solutions | ||

| ||||

2023 Capital Deployment | |||

2022 Proxy Statement 2022 Proxy Statement | |||

IQVIA’s 20by25 Strategy

When we formed IQVIA in 2016, we were focused on bringing analytics and technology to the clinical trial process. We worked for three years to fully integrate these capabilities and begin to realize the full value of the merger between IMS Health and Quintiles (the “Merger”). In 2019, we launchedVision 2022, a strategy to fully leverage our newly-combined assets to accelerate our growth beyond our post-Merger achievements. Since that launch, we have invested heavily in the use of technology, information, and analytics to expand our portfolio of offerings and further improve performance for ourselves and our customers. As Vision 2022 comes to a very successful conclusion, the next inflection point in our growth trajectory is what we call20by25, which represents our goal to realize at least $20 billion in revenue by 2025. This target reflects an acceleration of our innovation-led annual growth rate to at least double digits, which—given the scale of our revenues—represents a formidable challenge. Nevertheless, we believe that this goal is supported by a large, growing business opportunity that we are uniquely positioned to capture a greater share of through our differentiated capabilities and our expansive customer base.

We are excited about where IQVIA is today and look forward to what it will become in the future.

| Invested for Growth $1,525M | • $996M Spend on M&A and Investments • $649M Capital Expenditures | |

| Returned to Stockholders $992M | • ~5.0M Shares Repurchased • $197 Average Repurchase Price Per Share |

(2) Underlying Revenue Growth is defined as constant currency growth excluding revenues from COVID-19 related projects from both 2022 and 2023.

IQVIA HOLDINGS INC.  |

Commitment to Public Health

We intend to achievepursue our corporate purpose of advancing healthcare outcomes for patients by overcoming some of the biggest challenges facing global health, through collaborations with numerous stakeholders in the healthcare ecosystem. We are passionate about helping clientscustomers pursue this goal, and we continuously push ourselves to do more to advance public health efforts and improve health for all.

We are committed to doing our part by harnessing our resources and expertise to identify, understand and address unmet public health needs. We believe that by unleashing the power of Human Data Science—the integration of the study of human science with breakthroughs in data science and technology—we can reimagine ways to address the most complex global health challenges.

We do not undertake these challenges alone. Working in partnership with life science companies, medical researchers, government agencies, payers, nonprofit organizations and other healthcare stakeholders, we deliver insights and solutions that make meaningful differences in global public health.

At the Forefront of Creating a Healthier World

We are on the frontlines of the global public health conversation through ongoing

Our work with nonprofit organizations, government agencies, non-governmental organizations (NGOs), patient advocacy groups and other healthcare stakeholders.stakeholders puts us on the front lines of the global public health conversation. We are settingset the agenda for public discussion of healthcare topics—ranging from biosimilar sustainability to orphan drug development and biopharmaceutical innovation—by regularly publishing original, independent reports.

Accesstoinfrastructureandstandards. IQVIA is a preferred provider to a consortium of 14infrastructure and standards. We actively build collaborations in the global health Product Development Partnerships, fundedspace, with the aim to promote health equity in part bydeveloping nations and improve health outcomes globally. These projects often span several years and include a mix of sponsorship and sharing of our knowledge and experience. At an international level, we have ongoing relationships with the World Economic Forum, the Bill and Melinda Gates Foundation. By partnering withFoundation and the consortium members, IQVIA provides accessGlobal Fund to Fight AIDS, Tuberculosis and Malaria. Through these collaborations, we utilize our capabilities and networks to enable progress on global clinical development infrastructure and standards, particularly in the areas of infectious diseases such as HIV, malaria and tuberculosis.health challenges.

Patient empowerment. empowerment.We have a long-standing commitment to pursue patient engagement strategies to better educate and include patients in the evolving clinical research environment. This important work is enabling people to receive health services, clinical trial education and active connections to clinical research programs across the globe.

Improving outcomes for patients and populations. outcomesforpatientsandpopulations.We dedicate a significant amount of time and resources to working alongside governments, NGOs, and academia to enable faster and more robust approaches to tackling some of the world’s most pressing health challenges. We create intelligent connections that enable these organizations to discover previously unseen insights, drive smarter decisions, and unleash new opportunities. We have joined numerous organizations to help develop, enhance and optimize patient registries, which play an important role in healthcare. Patient registries are collections of data related to patients with a specific diagnosis or condition that play an important role in healthcare. For example, in one consortium, after initiating a registry focused on colectomy patients, we saw a 30% reduction in urinary tract infections and a 22% reduction in surgical site infections following colectomy surgeries. In another partnership, we developed an algorithm using AI to identify misdiagnosed adult type 1 diabetes (T1D) patients. A third partnership created a network of clinical sites and patient advocacy partnerships that will share non-identified electronic health record (EHR) data.condition.

Diversityinclinicaltrials. Through industry partnerships and internal initiatives, IQVIA is a leader in driving increased diversity in clinical trials, which is essential to improve understanding of potential sources of outcome variability in trials and to creating equality in the broader healthcare system. Across our COVID-19 vaccine trials, for example, we achieved 1.7 times higher enrollment of diverse populations versus our peers.

Regulatory evolution. evolution.IQVIA works alongside regulators and policymakers to foster a regulatory environment that advances human health and the conduct of clinical trials. We wereModernizing clinical trials and evidence generation is at the only companycore of IQVIA’s mission and a key priority for regulators, especially following the pandemic. From validating decentralized trial approaches through regulatory engagement to early leadership in dose optimization trial designs, IQVIA is at the forefrontof trial optimization and shaping regulatory thinking.

Transforming public health in Africa. Alongside our industrypartnership with (RED) and The Global Fund (see page 46) and our contribution to actively participateresearch on antimicrobial resistance, we are partnering with stakeholders to support pandemic preparedness, develop a coordinated clinical trials ecosystem, evaluate healthcare supply chains and assess the deployment of digital health platforms in the developmentregion. In 2023, we held the second IQVIA Africa Health Summit in Kigali, Rwanda—a two-day event that brought together public health experts to share knowledge and passageexchange ideas about how to advance Africa’s health through data, technology and innovative research. More than 280 attendees participated, representing 28 countries, in interactive sessions covering topics such as driving health innovation through clinical research and the role of innovation in improving access to healthcare.

Pioneering New Heights for Diversity in Clinical Trials

IQVIA has developed significant capabilities to assist sponsors in enrolling diverse populations, including traditionally underserved communities, into clinical research studies. This is accomplished by embedding diversity across planning and execution of clinical trials that reflect the 21st Century Cures Act, including testifying beforecommunities impacted by the U.S. House Energydisease or conditions under study to advance scientific understanding, improve health equity and Commerce Health Subcommittee onaccelerate new therapies. IQVIA believes achieving diverse representation in clinical trials requires a proactive, concerted approach that begins at the topicearliest stages of “Modernizing of Clinical Trials.”trial

IQVIA HOLDINGS INC.  |

Combating COVID-19

In 2021, we continued to devote substantial resources to COVID-19-related efforts, including our work with clients, governments and public health agencies. We responded quickly to the call to leverage our capabilities and expertise to help contribute to the global understanding of the virus and its ongoing implications.

|

|

|

|

|

|

|

|

|

|

2022 2022 | 11 |

planning and is deliberately factored into site selection, site training and recruitment strategy. IQVIA’s multi-faceted, trial-lifecycle approach to Contentsachieving clinical trial diversity is designed to address known and suspected causes of underrepresentation, while also considering challenges specific to the therapeutic area and trials overall.

IQVIA has established its leadership position in this important initiative, working closely with health regulators, sponsors, and industry associations, along with making significant internal investments, to drive increased diversity in clinical trials, which we believe to be essential to understanding potential variability in treatment effect, inform better health care decisions and contribute to improving health equity.

Recently, we supported a large pharmaceutical company in a respiratory syncytial virus (RSV) vaccine trial and through use of our data and novel site and direct-to-patient strategies to increase ethnic diversity participation, we were able to achieve over 1.7 and 1.6 times higher enrollment rates of Black and Hispanic participants, respectively, than originally expected. This built on the success we achieved across our COVID-19 vaccine trials, where we achieved 1.7 times higher enrollment of diverse populations than our peers.

Leveraging a distinctive combination of diversity regulatory insights, epidemiology and therapeutic expertise and data assets, IQVIA supports sponsors both large and small in developing meaningful and achievable diversity plans for regulators.

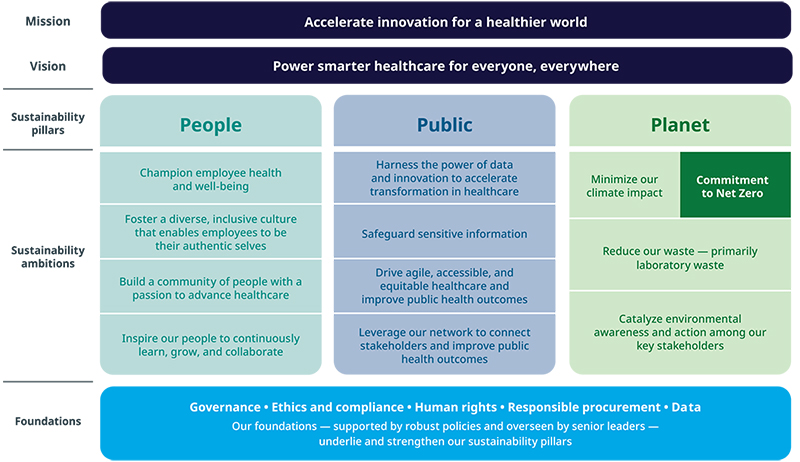

Sustainability and ESG Highlights

We are committed to continuingdelivering on our leadership position in sustainable ESG practices that further our corporate purpose of helping our clients improve healthcare outcomes for patients. Sustainability is a core consideration in achieving this—identifying and acting on the environmental, social and governance (ESG) issues most relevant to our business and stakeholders. Our sustainable business practices are organized in this Proxy Statement under the three pillars of our ESG program — People, Public and Planet.

As an industry leader, we continually look for ways to advance and strengthen our sustainability and citizenship efforts and report on our progress. You can find more details about all the topics below as well as other important information related to our sustainability effortsprogress each year in our 2021annual ESG Report, which is available on our website at https://www.iqvia.com/esg.

IQVIA HOLDINGS INC.  2024 Proxy Statement 2024 Proxy Statement | 12 |

|

Select highlights of our |

Environment • • • IQVIA worked closely with its supply chain to develop strategies to further reduce GHG emissions, resulting in 33% of IQVIA’s in-scope suppliers by emissions having or having committed to science-based targets Governance • Adopted stockholders’ right to request a special meeting of stockholders • Adopted two clawback policies, one applicable to our

• For the seventh year in a row, IQVIA was named one of the World’s Most Admired Companies in FORTUNE’s annual survey. For the third year in a row, IQVIA was named the number one most admired company in our Human Capital • Racial, ethnic and gender diversity for • • Disclosed specific targets on employee engagement

|

See pages 34-4338-48 for more information regarding our sustainability and ESG program.

IQVIA HOLDINGS INC.  |

Corporate Governance Highlights

We are committed to governance practices and policies that serve IQVIA’s long-term interests and contribute to the creation of stockholder value. Below are highlights of the advancements we made in our corporate governance practices and policies.

2022 2022 | 13 |

The following table summarizes certain highlights of our corporate governance practices and policies.

Corporate Governance Highlights

| BOARD OF DIRECTORS | |||||

| Our current director nominees, representing 60% of our Board, are each up for election to a one-year term this year | ||||

| Annual election of 100% of our directors beginning in 2025 | ||||

| Lead Independent Director, elected by the independent directors, |

| |||

| All directors except our | ||||

| |||||

|

| 50% of | |||

|

|

| |||

|

| ||||

Director retirement policy at age 74 to encourage board refreshment |

| ||||

|

| Annual Board and | |||

| |||||

| STOCKHOLDER RIGHTS AND ENGAGEMENT | |||||

| Stockholder proxy access | ||||

| Stockholder right to call a special meeting | ||||

| Active stockholder outreach and engagement program | ||||

| Single class of voting stock | ||||

| No supermajority voting requirement for stockholders | ||||

| No “poison pill” (stockholder rights plan) | ||||

| GOVERNANCE BEST PRACTICES | |||||

| Two clawback policies, one applicable to our Section 16 officers in the event of a material financial restatement and a second, supplemental clawback policy that applies to a wider set of employees and covers a broader set of misconduct | ||||

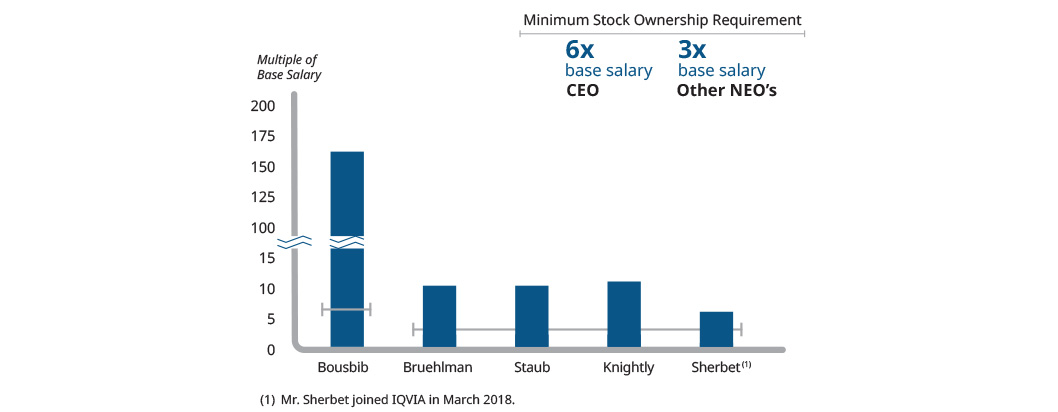

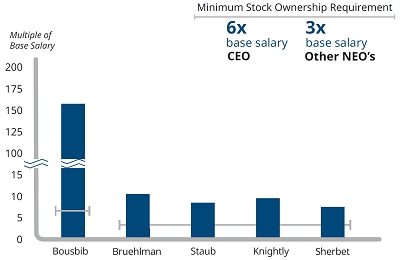

| Robust share ownership guidelines for both directors and key executives | ||||

| Securities Trading Policy in place, including anti-hedging and anti-pledging terms, without exception | ||||

|

|

| |||

|

| Comprehensive Whistleblower Policy in place | |||

| Rooney Rule policy requiring formal director and CEO searches |

| |||

|

| No excise tax gross-ups on severance or change in control payments or benefits | |||

| Annual say-on-pay vote | ||||

| Multi-year vesting requirements for performance share awards | ||||

| Long-term incentive compensation delivered in performance-based equity | ||||

See pages 25-4526-50 for more information regarding our corporate governance.

IQVIA HOLDINGS INC.  2024 Proxy Statement 2024 Proxy Statement | 14 |

Director Snapshot

The following table provides information about our Nominees,director nominees, assuming they are reelected at the 2022 Annual Meeting,2024 annual meeting and continuing directors.

Director | Age | Term Ends | Independent | Audit | N&G | LDC | Director Since |

John P. Connaughton | 56 | 2025 | Y |

|

| X | 2008 |

John G. Danhakl | 65 | 2025 | Y |

| X | X | 2016 |

James A. Fasano | 52 | 2025 | Y | Chair |

|

| 2016 |

Leslie Wims Morris | 51 | 2025 | Y |

| X |

| 2022 |

Ari Bousbib, Chairman and CEO | 60 | 2024 | N |

|

|

| 2016 |

Carol J. Burt | 64 | 2023 | Y | X |

| X | 2019 |

Colleen A. Goggins | 67 | 2023 | Y | X | X |

| 2017 |

John M. Leonard, M.D., Lead Director | 64 | 2024 | Y | X | X |

| 2015 |

Ronald A. Rittenmeyer | 74 | 2023 | Y | X |

| Chair | 2016 |

Todd B. Sisitsky | 50 | 2024 | Y |

| Chair | X | 2016 |

Sheila A. Stamps | 64 | 2023 | Y | X |

|

| 2022 |

2022 Proxy Statement 2022 Proxy Statement |

| Director | Age | Term Ends | Independent | Audit | N&G | LDC* | Director Since |

| Ari Bousbib, Chairman and CEO** | 62 | 2025 | N | 2016 | |||

| Carol J. Burt** | 66 | 2025 | Y | X | Chair | 2019 | |

| John P. Connaughton | 58 | 2025 | Y | X | 2008 | ||

| John G. Danhakl | 67 | 2025 | Y | X | X | 2016 | |

| James A. Fasano | 54 | 2025 | Y | Chair | 2016 | ||

| Colleen A. Goggins** | 69 | 2025 | Y | X | Chair | 2017 | |

| John M. Leonard, M.D., Lead Independent Director** | 66 | 2025 | Y | X | X | 2015 | |

| Leslie Wims Morris | 53 | 2025 | Y | X | 2022 | ||

| Todd B. Sisitsky** | 52 | 2025 | Y | X | X | 2016 | |

| Sheila A. Stamps** | 66 | 2025 | Y | X | 2022 |

* The Leadership Development and Compensation Committee (LDC Committee).

** Director nominees up for election to Contentsone-year terms.

Declassification of Board of Directors

At our 2022 annual meeting, stockholders provided overwhelming support for the Company’s proposal to declassify our Board. As a result, we amended our Certificate of Incorporation to eliminate the classification of our Board over a three-year period beginning with the 2023 Annual Meeting. Beginning with the 2025 annual meeting, 100% of our director nominees will be elected for one-year terms. All of our 2024 director nominees, representing 60% of our Board, are up for election to one-year terms this year and 100% of our directors will be up for election to one-year terms in 2025.

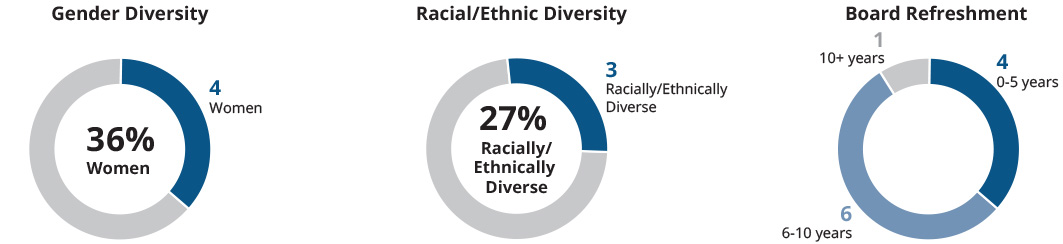

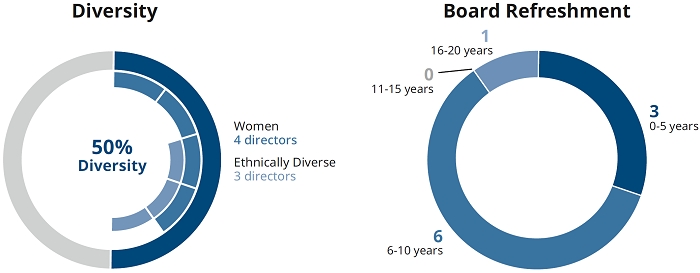

Board Diversity

The following graphics provide information about the diversity of our Board.

IQVIA HOLDINGS INC.  2024 Proxy Statement 2024 Proxy Statement | 15 |

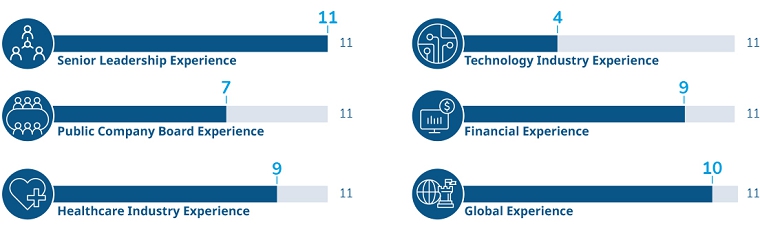

Qualifications and Experience of Directors

We believe our directors bring a well-rounded variety of experience, qualifications, attributes and skills, provide fresh perspectives and represent a mix of deep knowledge of the Company and fresh perspectives.our industry. As we review our long-term strategy, we also evaluate what current and future skills and experience our Board requires, and we weigh those skills when assessing our current directors and potential director candidates. The table below summarizes certain of our directors’ key experiences, qualifications and core competencies.(1)(1)

This summary is not intended to be an exhaustive list of each of our directors’ skills or contributions to the Board.

| Ari Bousbib | Carol J. Burt | John P. Connaughton | John G. Danhakl | James A. Fasano | Colleen A. Goggins | John M. Leonard M.D. | Leslie Wims Morris | Todd B. Sisitsky | Sheila A. Stamps | |

| Public Company CEO/ President Experience serving as CEO or President of a publicly-traded company |  |  |  | |||||||

| Public Company Board Experience serving on and/or leading boards/ committees of other large publicly-traded companies |  |  |  |  |  |  |  |  |  | |

| Healthcare Experience in executive positions within the healthcare industry |  |  |  |  |  |  |  |  | ||

| Technology Knowledge or experience that contributes to the Board’s understanding of technology and/or data protection and/or cybersecurity |  |  |  |  |  |  |  | |||

| Financial Experience analyzing financial statements, capital structures and complex financial transactions, and overseeing accounting and/or financial reporting processes |  |  |  |  |  |  |  |  |  |  |

| Global Experience operating in a global context internationally or at a global company |  |  |  |  |  |  |  |  |  |  |

| Government &Public Policy Experience in government role, public service, government affairs or community relations |  |  |  |  |  | |||||

| Diversity Racial/ethnic or gender diversity |  |  |  |  |  |

| (1) | This summary is not intended to be an exhaustive list of each of our directors’ skills or contributions to the Board. |

IQVIA HOLDINGS INC.  |

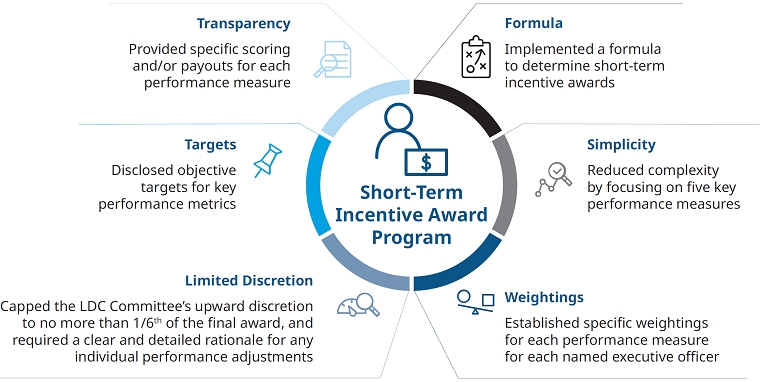

Executive Compensation Practices Highlights

In 2020, following extensive stockholder engagement, the Leadership Development and Compensation (LDC) Committee of the Board revamped our short-term incentive program and accelerated the implementation of the changes planned for 2021 to apply to our 2020 compensation decisions.

The key features of the new program, which are consistent with the feedback received from stockholders, are summarizedhighlighted below.

Say-on-Pay

The Board and the LDC Committee strive to ensureBelow we highlight key practices that we consider good governance features of our executive compensation program alignsprogram.

| WHAT WE DO | ||||||

| Align significant percentage of executive pay with performance |  | Use an objective, formulaic approach to determining short-term incentive awards | |||

| Annual say-on-pay vote |  | Appropriately balance short- and long-term incentives | |||

| Set challenging yet achievable performance objectives for our named executive officers |  | Conduct annual performance evaluations of the named executive officers at the LDC Committee level | |||

| Conduct an annual compensation risk review and assessment |  | Limit LDC Committee discretion to adjust short-term incentive awards to no more than 1/6th of the final award | |||

| Offer transparent disclosure of achievements for all performance measures and metrics used to determine short-term incentive awards |  | Align executive compensation with stockholder returns by providing the majority of total compensation in the form of performance-based long-term incentive awards | |||

| Align executive compensation with progress on ESG matters by including specific ESG-related objectives in our short-term incentive award program |  | Regularly engage with our stockholders on our compensation program and implement enhancements based on feedback received | |||

| Use multi-year vesting requirements for long-term awards |  | Utilize expertise of an external independent compensation consultant | |||

| Include non-solicitation and non-competition provisions in award agreements |  | Disclose targets for long-term incentive awards upon vesting | |||

| Cap the payout at target for the portion of performance share awards based on Relative Total Shareholder (TSR) if our absolute TSR for the three-year performance period is negative |  | Have two clawback policies, one applicable to our Section 16 officers in the event of a material financial restatement and a second, supplemental clawback policy that applies to a wider set of employees and covers a broader set of misconduct | |||

| Maintain meaningful share ownership guidelines |  | Utilize a competitive peer group | |||

IQVIA HOLDINGS INC.  2024 Proxy Statement 2024 Proxy Statement | 17 |

| WHAT WE DON’T DO | ||||||

| Sign contracts with multi-year guaranteed salary increases or non-performance bonus arrangements |  | Reprice underwater stock options or Stock Appreciation Rights (SARs) without stockholder approval | |||

| Gross up for excise taxes |  | Pay unearned dividends prior to vesting | |||

| Have single-trigger equity vesting |  | Allow hedging or pledging of Company shares | |||

Enhancements to 2023 Long-Term Performance Awards Based on Investor Feedback

To further align the interests of our executive officers with those of our stockholders, a substantial portion of the total compensation paid to our executive officers is delivered in the form of performance-based and reflectstime-based equity awards. Performance share awards (also referred to as PSUs herein), which are earned over a three-year period, are based on Adjusted (Earnings Per Share) EPS performance, which accounts for 75% of the award, and Relative Total Stockholder Return (Relative TSR) performance, which accounts for 25% of the award. The number of performance shares a named executive officer may earn ranges from 0% of the executive’s target award to 200% of the target award. Prior to 2023, even if our pay-for-performance philosophy. In 2021,Relative TSR performance was negative, executives could still earn up to 200% of that portion of the Board committedaward depending upon our performance relative to implementing the say-on-pay frequency approved by a majority of stockholders atS&P 500 over the 2021 annual meeting of stockholders. Following that meeting, at which approximately 96% of stockholder votes favored annual say-on-pay advisory votes, the Board adopted annual say-on-pay until the next required say-on-frequency vote.

three-year performance period. See pages 49-8069-71 for more information regardingon our Long-Term Incentive Awards.

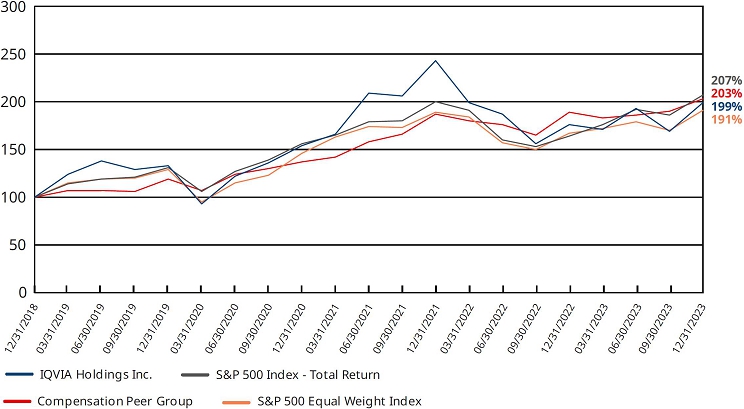

New for 2023. In response to investor feedback, and after a review of market practice, the LDC Committee changed the criteria used to select the Company’s compensation peer group to better align with the Company’s near-term strategic objectives and, based on the new criteria, selected a new compensation peer group used for all named executive officers, including our Chief Executive Officer, eliminating the supplemental compensation program.peer group previously used for our Chief Executive Officer. We also significantly increased disclosure about the criteria used to select the compensation peer group.

New for 2023. In response to investor feedback, and after a review of market practice, the LDC Committee adopted a policy, beginning with the 2023 performance share awards granted to our named executive officers, to cap the payout at target for the portion of performance share awards based on Relative TSR if our absolute Total Stockholder Return (TSR) for the three-year performance period is negative.

New for 2023. In response to investor feedback and to further align the interests of our named executive officers with stockholders, the LDC Committee changed the mix of equity awards granted to our named executive officers to increase the percentage of performance share awards as a percentage of the total long-term incentive awards granted from 50% in 2022 to 75% in 2023. Time-based restricted stock unit awards are no longer included in our annual long-term incentive awards granted to our named executive officers.

New for 2023. In response to investor feedback, the LDC Committee approved an increase in the Relative TSR target performance from the median to the 55th percentile for the three-year TSR vs. Relative TSR performance metric of our performance share awards to receive a target payout of 100% for that portion of the performance share awards.

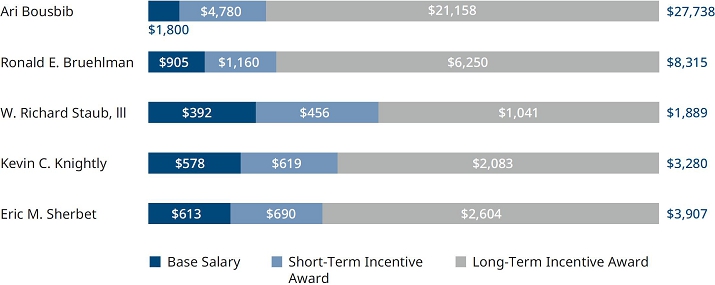

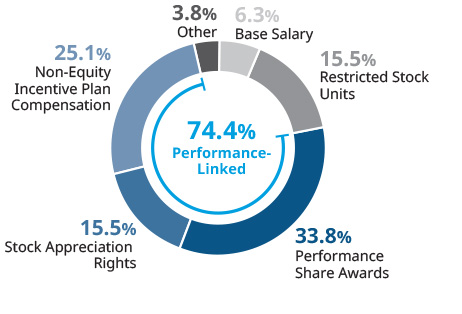

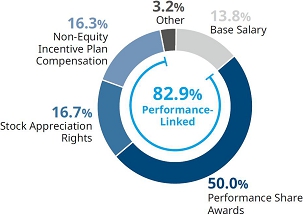

CEO and Named Executive Officer Pay Mix

The following charts reflect the mix of pay for our Chief Executive Officer (89.0% performance-linked) and the average for our other named executive officers (82.9% performance-linked).

IQVIA HOLDINGS INC.  2024 Proxy Statement 2024 Proxy Statement | 18 |

Upon the recommendation of the N&G Committee, the Board has nominated each of Ari Bousbib, Carol J. Burt, Colleen A. Goggins, John P. Connaughton, John G. Danhakl, JamesM. Leonard, M.D., Todd B. Sisitsky and Sheila A. Fasano, and Leslie Wims MorrisStamps for election forto a new term as a Class III directorof one year at the 20222024 Annual Meeting. Ms. Wims Morris was appointed as a director by the Board, following the recommendation of the N&G Committee, in January 2022 after an extensive search.

|  |  | |

| Ari Bousbib | Carol J. Burt | Colleen A. Goggins | |

|  |  | |

| John |

|

|

|

If elected, each Class IIIof the six director nomineenominees will serve for a term of three yearsone year and until his or hertheir successor is duly elected and qualified or until his or hertheir earlier death, resignation, retirement, disqualification or removal.

The Board believes that each of the nominees has a record of integrity, a strong professional reputation, and a history of entrepreneurial or managerial achievement. The specific experience, qualifications, attributes and skills of each nominee that led the Board to conclude that the individual should serve as a director are described in their respective biographies below.

Shares represented by executed proxies will be voted if authority to do so is not withheld, for or against or abstained from voting on the election of the foursix nominees named above. If a nominee becomes unavailable for election or unable to serve as a director, and the Board does not choose to reduce the size of the Board, such shares will be voted for the election of such substitute nominee as the Board may propose. Each nominee has agreed to serve if elected, and management has no reason to believe that any nominee will be unable to serve.serve if so elected. Directors are elected by a pluralitymajority of the votes cast. Pursuant to our Director Resignation Policy, any director who fails to receive a majority of votes cast in an uncontested election must tender his or her resignation to the Board.

THE BOARD RECOMMENDS A VOTE “FOR” THE ELECTION OF EACH NAMED NOMINEE

For | THE BOARD RECOMMENDS A VOTE “FOR” THE ELECTION OF EACH NAMED NOMINEE. |

IQVIA HOLDINGS INC.  |

Board of Directors

Our

The Board is currently made up of eleventen directors. Set forth below is biographical information for each of the Class III director nominees and all of the continuing directors. The biographies also note the specific skills and experience that make these individuals well-qualified to serve on the Board.

ClassIIIDirectors

Director Nominees forElectiontoaThree-Year One-Year TermExpiringatthe2025AnnualMeetingofStockholders

| Age: | |

Director since:

| ||

| ||

|

|

Recent Experience:

IQVIA Holdings Inc. (2016-present)

| ||

| ||

| ||

|

|

2022 Proxy Statement 2022 Proxy Statement |

| ||

| ||

| ||

|

|

| ||

| ||

| ||

|

|

2022 Proxy Statement 2022 Proxy Statement |

ClassIDirectors

| ||

| ||

| ||

|

|

| ||

| ||

| ||

|

|

2022 Proxy Statement 2022 Proxy Statement |

| ||

| ||

| ||

|

IMS Health Holdings, Inc. (2010-2016)

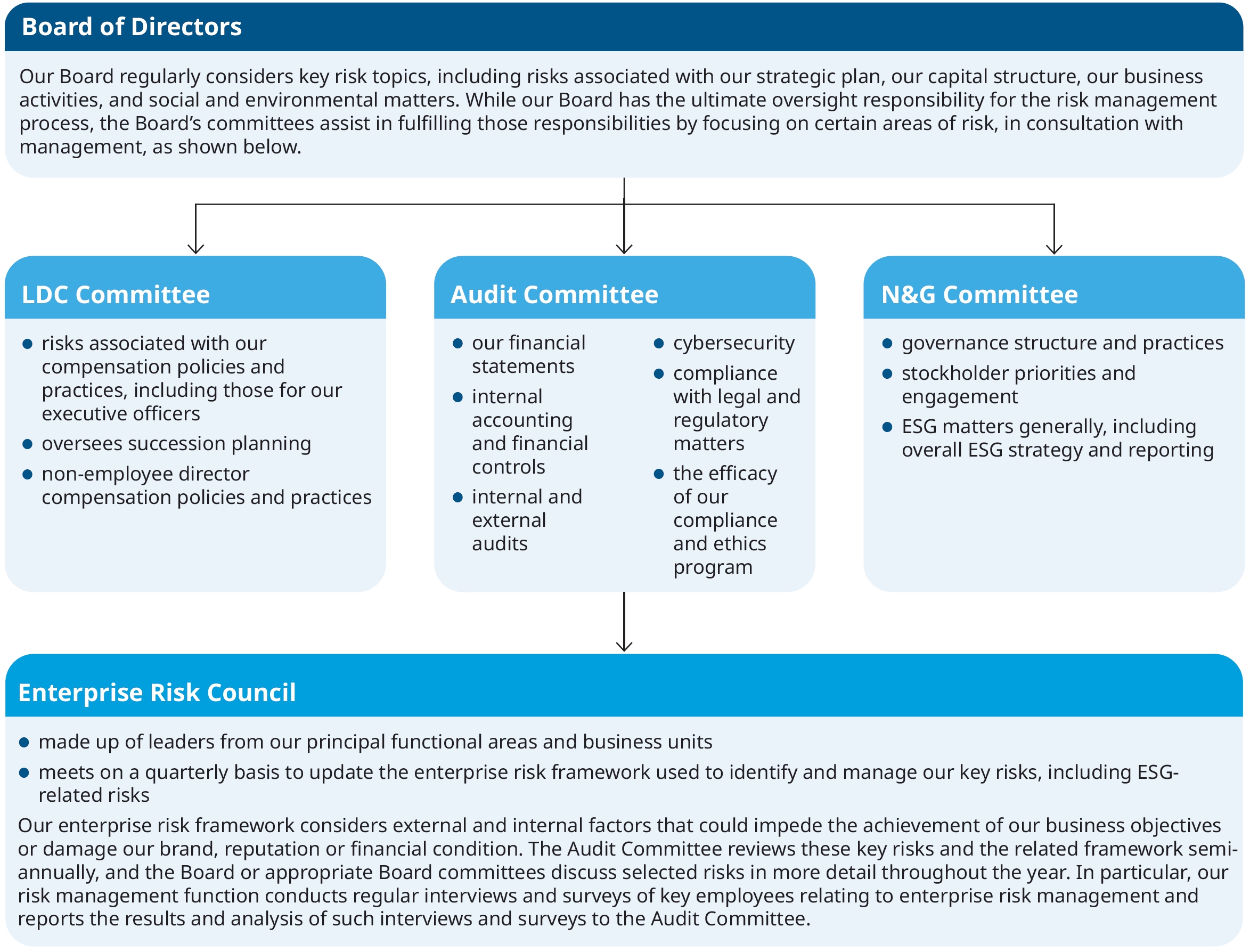

Prior Experience: